Your Proper Destination for Correct Direction,Correct Advice --always be front-liner than others by proper information.Be informed of BSE,NSE listed Stock Buy and Sell.

Wednesday, 1 December 2021

TECHNICAL BUY OF THIS PHARMA PLAYER- Dishman Carbogen Amcis Ltd:

Friday, 1 October 2021

RALLIS INDIA REVIEW FOR BUYING

Saturday, 11 September 2021

Most Undervalued Electrical Vehicle Related Stock for Future Multibagger

Amara Raja Batteries (ARBL), the flagship company of the Amara

Raja Group is a leading manufacturer of automotive batteries under the brands

- Amaron and PowerZone

In India, Amara Raja is the preferred supplier to major

telecom service providers, Telecom equipment manufacturers, UPS sector (OEM

& Replacement), Indian Railways and to Power, Oil & Gas, Passenger

Vehicles, Three Wheelers, Two Wheelers, Commercial Vehicles, Farm Vehicles,

Inverters. Additionally, Amara Raja Industrial Batteries offers a wide scope of

battery arrangements in portions like UPS, Telecom, Railways, Defense, and

Motive.

Most investors are disappointed who already stay invested in Electrical vehicle-related Stocks in perception for EV Boom but fruits are not riped till now. But remember this is high time to invest in Electrical vehicle-related Stocks. I have found out this very strong potential and undervalued growth stock which is fundamentally very strong for its consistent growth potential

Ø Amara Raja Batteries Ltd's earnings have grown

by 5.5%, whereas share price has declined -6.6% CAGR over the past five years,

indicating the company’s share price is likely undervalued.

Ø Amara Raja Batteries Ltd share price has

appreciated 20.3% annually (CAGR) over the past ten years.

Ø Amara Raja Batteries and Exide Industries each

have 30% market share in this industry in India

Ø Amara Raja Batteries already has a foreign

partner. Johnson Controls holds a 26% stake in the company. Johnson Controls has

the uniqueness to provide technical support and gain a stake in the company.

52 weeks High / Low Ratio | 1026/665 =1.54 | <2.2 is Good | |

Current Ratio | 1.96 | > 1.25 is Good, | A liquidity ratio that measures a company's ability to pay short-term obligations. The higher the current ratio, the more capable the company is of paying its obligations. |

Quick Ratio (x) | 0.85 | > 1 is Good, | The quick ratio measures a company's ability to meet its short-term obligations with its most liquid assets. For this reason, the ratio excludes inventories from current assets |

Sales growth | 15% | CAGR >15% for last 7-10 years | Growth should be consistent year on year. Ignore companies where a sudden spurt of sales in one year is confounding the 10 years performance. Very high growth rates of >50% are unsustainable. |

Price to Sales ratio (P/S ratio) | 1.56 | < 1.5 is Good | James O’Shaughnessy: Buy if P/S ratio is < 1.5 and sell if >3 |

Price to Book value Ratio(P/B Ratio) | 2.93 | For a Good Company 3 – 6 is Ok & | A stock is termed as undervalued if it has a lower P/B ratio. A low P/B ratio may also mean a company has some problems with its fundamentals. |

Return On Asset (%) | 11.8 | > 5% is Good, | An indicator of how efficient management is at using its assets to generate earnings. Calculated by dividing a company’s annual earnings by its total assets |

Return On Equity (%) | 16.2% | > 10% is Good, | Also called Return on net worth, it measures a company’s profitability by revealing how much profit a company generates with the money shareholders have invested, it is calculated by dividing the net profit after tax by shareholder's fund For high-growth companies you should expect a higher ROE. |

Cash Flow from Operation | 802 Cr | CFO>0 | Positive CFO necessary |

Tax Payout | 26% | >30% Good | The tax rate should be near the general corporate tax rate unless some specific tax incentives apply to the company. |

Profitability (Net profit Margin) | 9% | >8 is Good | Look for companies with sustained operating profit & net profit margins over the years |

P/E ratio | 17.4 Industry P/E 21.4 | <Industry P/E is Good. | The P/E ratio is the most widely used parameter to analyze whether the stock of any company is overvalued or undervalued at any point in time. It is calculated by dividing the current market price (CMP) of stock by profit/earnings per share (EPS). |

Dividend Yield (%) | 1.52% | > 0 is Good, | A financial ratio that shows how much a company pays out in dividends each year relative to its share price. The dividend yield is calculated as annual dividends per share divided by market price per share. |

P/E to Growth ratio (PEG ratio) | 3.15 | <1 is Good | The price/earnings to growth ratio (PEG ratio) is a stock's price-to-earnings (P/E) ratio divided by the growth rate of its earnings for a specified time period. The PEG ratio is used to determine a stock's value while taking the company's earnings growth into account and is considered to provide a more complete picture than the P/E ratio. |

Promoter shareholding | Promoter-28.1% Public- 34.6 % FII-22.1 % DII-15.24 % | > 30% (Must for Promoter) | Higher the better |

Interest Coverage Ratio | 88 | > 2 is Good, | It is used to determine how easily a company can pay interest on outstanding debt. It is calculated by dividing a company's EBIT by interest expenses. |

Debt Equity Ratio | 0.02 | < 1 is Good, | A measure of a company's financial leverage is calculated by dividing its total liabilities by stockholders’ equity. The debt/equity ratio also depends on the industry in which the company operates. |

What is the Intrinsic Value of AMARA RAJA BATTERIES?

As of 09-Sep-2021, the Intrinsic Value of AMARA RAJA

BATTERIES is Rs. 989.31 determined based on Median of the 3

historical models.

Fair Value [Median EV / EBIDTA Model] : Rs. 952.80

Fair Value [Median EV / Sales Model] : Rs. 1,016.93

Fair Value [Median Price / Sales Model] : Rs. 989.31

Median Fair Value of AMARA RAJA BATTERIES: Rs. 989.31

As of 09-Sep-2021, AMARA RAJA BATTERIES is trading at a

Discount of -27% based on the estimates of Median Intrinsic Value!

6th UP TARGET 2111.46 5th UP TARGET 1730.62 4th UP TARGET 1495.21 3rd UP TARGET 1259.81 2nD UP TARGET 1125.00 1sT. UP TARGET 1020.00

Saturday, 17 April 2021

Technical Buy Wipro Limited

Buy IT Giant Wipro Limited for multi fold Return(CMP-469.20)

Support Level are 450/430/400

Saturday, 10 April 2021

Bhansali Engineering-A Technically Bullish Stock

Bhansali Engineering is Ready to Huge Up move(CMP-163.80)

Saturday, 3 April 2021

TECHNICAL TALK OF BULLISH BREAKOUT STOCKS

KANCHI KAPOORAM LIMITED(CMP Rs. 818)

After 12/3/21 Kanchi Kapooram starts nonstop upward journey crossing previous top 562.From 16/2/21 to 26/03/21 corrected 50 % Fibonacci retracement following downtend channel which is technically a BULL FLAG PATTERN.Just before 3 session a bullish breakout of bull flag done.So for short to medium term stock may shoot up targeting Rs. 1075 keeping Stop loss Rs.700.Sunday, 7 February 2021

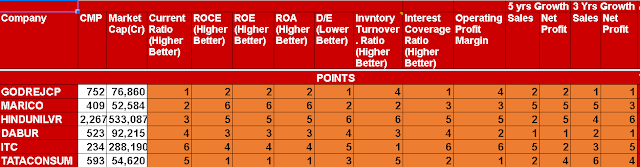

Which is The No 1 FMCG Company In India ?

Our Everyday life is solely dependent on FMCG (Fast Moving Consumer Goods) products from morning to night.This Sector is the India's fourth largest sector & engaged 3.2 million people directly or indirectly.The demand of FMCG products are growing rapidly.Due to low cost & very fast consumption, FMCG products are produced in large volume. This sectors basically covers Processed foods, Drinks,Beverages,Personal care products,Medicines,Cleaning Products,Toiletries,Office Supplies

Today we have done detailed fundamental comparison of top 6 FMCG Companies in India. This companion is based on Quality & Valuation.

Comparison Of 6 good FMCG Companies by Fundamental Analysis.

Companies selected for analysis

1) GODREJCP 2) MARICO 3) HINDUNILVR

4) DABUR 5) ITC 6) TATA CONSUMER

A) Comparison considering Quality

Here we have analysed considering ten matrices as below :

Comparing the quality aspects HINDUNILVR is Ranked One & GODREJ CONSUMER Is Ranked Sixth.

A) Comparison considering Valuation

Here we have valued Stock Price((Highest(6) to Lowest(1)) considering ten matrices as below :

Comparing the Valuation aspects ITC is Ranked One (Cheapest Price) & DABUR is Ranked Sixth (High price).

Please note that this is not any buy and sell recommendation

, only a comparative study for education purpose only.

Sunday, 17 January 2021

Technical & Fundamental View Of FMCG Major ITC

ITC has diversified product portfolio in Branded Packaged

Foods, Personal Care, Education and Stationery, Agarbattis & Safety

Matches, Lifestyle Retailing, Cigarettes & Cigars, Hotels, Paperboards

& Specialty Papers, Packaging, Agri-business & IT.

ITC seeks to be emerge as an engine of growth in the Indian

economy through a vibrant portfolio of future-ready businesses that are well

poised to serve the emerging needs of future

market. The synergies between ITC’s diverse businesses lend competitive

strength to each other. ITC aspires to be a leader in every business segment

that it operates in, whilst creating sustained value for all stakeholders.

ITC has made tremendous effort to decrease its dependence on

cigarette business. It has been successfully able to mobilise all its funds

generated from the business of Tobacco, in other fast-growing sectors like

FMCG, Agri- products, and hospitality chains.

-:Fundamental Analysis :- -:Company Snapshot & Brand Strength :-

3) ITC exports 90 Countries

4) 40 lacks farmers are involved

lacs retail outlets.

million retail outlets

8) Bingo! Is No. 1 in Bridges segment of Snack

Foods (No.2 overall in Snacks &

Potato

Chips)

9) Sunfeast is No. 1 in Cream Biscuits

10) Classmate is No. 1 in Notebooks

11) YiPPee! is No. 2 in Noodles.

12) Fiama is No.2 in Body Wash

13) Mangaldeep is No. 2 in Agarbattis (No. 1 in Dhoop segment)

-:Financial Health:-

-:Sales &

Profit Growth:-

- Last 10 Years Compounded Sales Growth 10%

- Last 10 Years Compounded Profit Growth 14%

- Stock is providing a good dividend yield(4.66%)

- Company has been maintaining a healthy dividend payout

-:Free Cash Flow Trend Analysis:-

Free cash flow is the

money which has left over after it has paid for everything

it needs to continue operating—including buildings, Property, plant, equipment,

payroll, taxes, and inventory.It is also Called Owner's earnings.

-:Liquidity Analysis:-

Over the last 5 years, ITC has maintained free cash flow

growth has been 13.36%, vs industry avg of 13.93%

Company has been maintaining a healthy dividend payout

Company is almost debt free (Debt to equity ratio-0.01)

Current Ratio-2.91 (>1.25 is Good)

Current Ratio-2 (>1 is Good)( The quick ratio measures a company's ability to meet its short-term obligations with its most liquid assets. For this reason, the ratio excludes inventories from current assets)

So Company has good Liquidity which help company to survive in adverse time also.

-:Profitability Analysis -

Company is consistently maintaining High Return Of Equity (ROE>15 Very Good) & High Return Of Capital Employed(ROCE>15% is Good) & Good ROA

-:Valuation -

- The Present Price to Earning Ratio(PE ratio) is 14.47 Which is lower than industry average 49.4

- EPS is steadily growing from Rs. 4.30 in 2011 to Rs. 12.31 in 2020

Conclusion : Analyzing all financial data, In respect of long term view ITC is a Very good investment bet & as per my view every investor must consider to include this dark horse in Portfolio.

Technical View

CMP of ITC is Rs. 217.85. ITC Recovers from March low low Rs.135 slowly following the uptrend Channel drawn red line.Now last 6 session price consolidate between Rs.200-220 & preparing to break out the channel.

The One interesting observation to be noted that Price mostly respects magic lines of green channel of 89 Moving Average, from very beginning of up journey .

In chart, 3 red arrows indicates efficient resistance by channel, 5 blue arrow shows good support zone.

In middle of June '2016 , green arrow shows that after breakout of green channel ,price steadily up move.

Now again that similar situation is arising if price able to cross the green channel & price sustain above Rs.225,don't miss the opportunity to buy for multibagger return .

Another notable observation is that from January'20 , significant volume increased which never observed earlier.

So watch out very closely in coming week.

Support =200-204

Resistance =237/276/315/354(Medium to long Target)