Our Everyday life is solely dependent on FMCG (Fast Moving Consumer Goods) products from morning to night.This Sector is the India's fourth largest sector & engaged 3.2 million people directly or indirectly.The demand of FMCG products are growing rapidly.Due to low cost & very fast consumption, FMCG products are produced in large volume. This sectors basically covers Processed foods, Drinks,Beverages,Personal care products,Medicines,Cleaning Products,Toiletries,Office Supplies

Today we have done detailed fundamental comparison of top 6 FMCG Companies in India. This companion is based on Quality & Valuation.

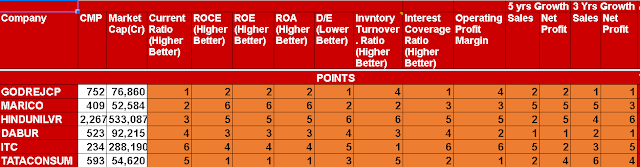

Comparison Of 6 good FMCG Companies by Fundamental Analysis.

Companies selected for analysis

1) GODREJCP 2) MARICO 3) HINDUNILVR

4) DABUR 5) ITC 6) TATA CONSUMER

A) Comparison considering Quality

Here we have analysed considering ten matrices as below :

Comparing the quality aspects HINDUNILVR is Ranked One & GODREJ CONSUMER Is Ranked Sixth.

A) Comparison considering Valuation

Here we have valued Stock Price((Highest(6) to Lowest(1)) considering ten matrices as below :

Comparing the Valuation aspects ITC is Ranked One (Cheapest Price) & DABUR is Ranked Sixth (High price).

Please note that this is not any buy and sell recommendation

, only a comparative study for education purpose only.

No comments:

Post a Comment